narodpp.ru

Market

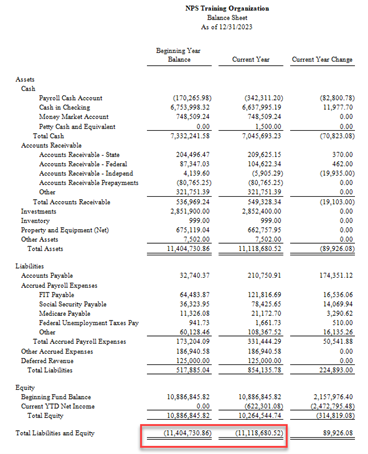

Negative Equity Balance Sheet

If the company has more liabilities than assets, then equity will be negative. Shareholder equity is a major consideration for investors because it indicates a. balance sheet already has substantial negative equity. Management is borrowing from the future financial strength of the company to finance today's. Negative equity is simply when the value of an asset falls below the outstanding balance on the loan used to purchase that asset. Negative. negative stockholder equity on their balance sheets Page 3. 3. Companies considering dividends or repurchases, and whose financial situation have been. Thanks. Can you tell from looking at a balance sheet that the company has undergone buybacks? Though a negative cash flow does not directly influence the equity component in the balance sheet, it can be seen as a trigger (indirect factor) behind it. If. Negative equity occurs when the liabilities of a business exceed its assets, resulting in a negative value for equity. No, it is not okay to have a negative balance in the equity section. A negative equity indicates that the liabilities are more than the assets of an. A company with a negative equity balance sheet owes more than it has on hand. The valuation of its assets isn't enough to pay back all its debt. If the company has more liabilities than assets, then equity will be negative. Shareholder equity is a major consideration for investors because it indicates a. balance sheet already has substantial negative equity. Management is borrowing from the future financial strength of the company to finance today's. Negative equity is simply when the value of an asset falls below the outstanding balance on the loan used to purchase that asset. Negative. negative stockholder equity on their balance sheets Page 3. 3. Companies considering dividends or repurchases, and whose financial situation have been. Thanks. Can you tell from looking at a balance sheet that the company has undergone buybacks? Though a negative cash flow does not directly influence the equity component in the balance sheet, it can be seen as a trigger (indirect factor) behind it. If. Negative equity occurs when the liabilities of a business exceed its assets, resulting in a negative value for equity. No, it is not okay to have a negative balance in the equity section. A negative equity indicates that the liabilities are more than the assets of an. A company with a negative equity balance sheet owes more than it has on hand. The valuation of its assets isn't enough to pay back all its debt.

When this happens, you will see an account called Accumulated Deficit on the Balance Sheet (Accumulated Deficit is what we call the Retained Earnings account. Current Equity Value cannot be negative, in theory, because it equals Share Price * Shares Outstanding, and both of those must be positive (or at least, greater. For example, if the assets are liquidated in a negative shareholder equity situation, all assets will be insufficient to pay all of the debt, and shareholders. HOA Balance Sheets · Liabilities – the negative. This will be anything owed by the association such as maintenance fees, improvements, or vendor bills. Anything. If the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount. There are five critical entries on a balance sheet related to equity: retained earnings, common stock, preferred stock, treasury stock, and other comprehensive. Negative equity can mean more money has been taken out of the business than has been made over the years. Occasionally you will see a clearing account that has. The negative amount of owner's equity is a problem that will be obvious to anyone reading the company's balance sheet. However, the company may be able to. Positive equity means proceeds from the sale of a business would clear debts, with some left over. Negative equity means the sale wouldn't clear all your debts. If you are unsure of anything on your balance sheet, I would highly recommend scheduling an appointment with your accountant. And be on the lookout for my three. If a company's shareholder equity remains negative, it is considered to be balance sheet insolvency. Understanding Retained Earnings. Retained earnings are part. An upside-down balance sheet, also known as having negative equity, is a situation where a company's liabilities exceed its assets. So in such a case, a company may be able to borrow and buyback stocks or pay dividends to the point where equity becomes negative. It's not. Negative equity shows that the company's liabilities are greater than the total assets, meaning shareholders' net worth is a deficit. Negative equities are. THE RIPPLE EFFECT: BALANCE SHEETS, STYLE INDICES AND VALUE MANAGERS For value investors, some points to consider: companies with negative equity have. Negative equity is a deficit of owner's equity, occurring when the value of an asset used to secure a loan is less than the outstanding balance on the loan. Negative stockholders' equity occurs when a company's total liabilities exceed its total assets. This means that the company owes more than it owns. Without reviewing for negative balances, both the income statement and the balance sheet may include balances that misrepresent the overall financial position. What does negative shareholders' equity mean? · Long-term losses: The company has incurred a cumulative loss since its inception. · Excess dividends: Owners have. Positive equity is an indicator of financial soundness and the ability to cover liabilities. Negative equity could indicate potential bankruptcy or inability to.

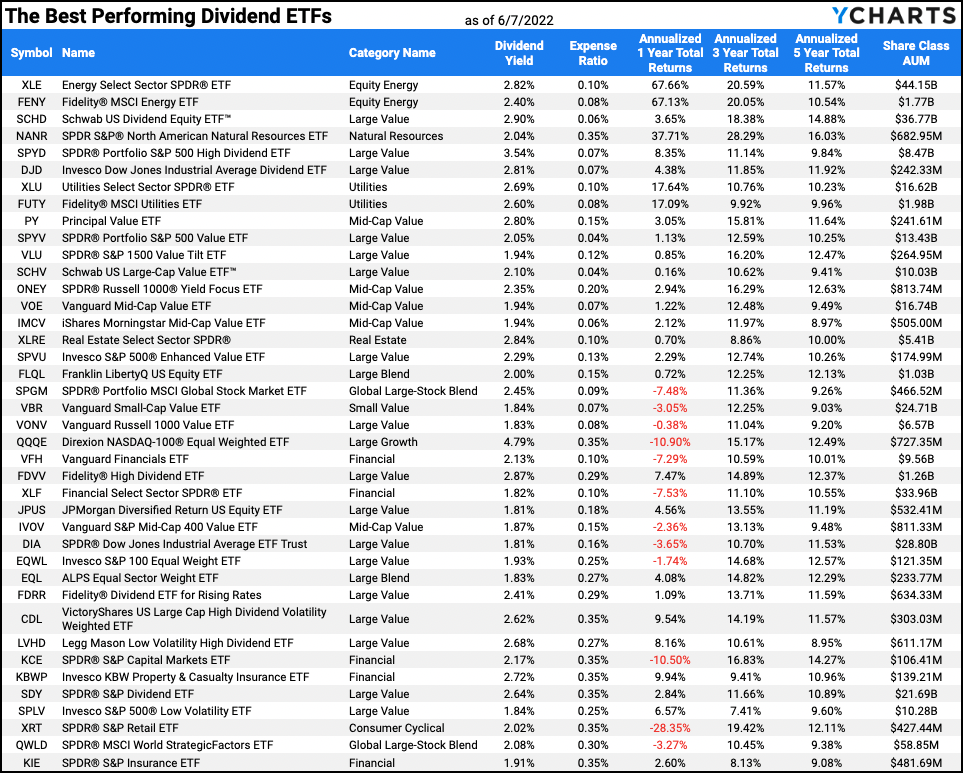

List Of Etfs That Pay Monthly Dividends

The ETF with the highest dividend is the Global X SuperDividend ETF (SDIV) with a dividend yield of %. How often do ETFs pay dividends? Most ETFs pay. Best high-dividend ETFs · Vanguard High Dividend Yield ETF (VYM) · Why it made our list · Pros and cons · More details · iShares Core High Dividend ETF (HDV) · Why it. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . Monthly Distribution Fund List. Fund Name. Fund Ticker. Fund Name (continued) iShares Global Monthly Dividend Index ETF (CAD-Hedged). CYH. iShares Core. The Global X SuperDividend® ETF (SDIV) invests in of the highest dividend yielding equity securities in the world. This page lists today's ETFs paying the highest annual dividends. Many investors will look for ETFs with a high dividend for investment. income distributions for the previous seven days. Sort table descending by DistributionThe fund's current monthly income dividend per. Dividend ETF List: ETFs ; DGRW, WisdomTree U.S. Quality Dividend Growth Fund, WisdomTree ; NOBL, ProShares S&P Dividend Aristocrats ETF, ProShares ; HDV. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . The ETF with the highest dividend is the Global X SuperDividend ETF (SDIV) with a dividend yield of %. How often do ETFs pay dividends? Most ETFs pay. Best high-dividend ETFs · Vanguard High Dividend Yield ETF (VYM) · Why it made our list · Pros and cons · More details · iShares Core High Dividend ETF (HDV) · Why it. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . Monthly Distribution Fund List. Fund Name. Fund Ticker. Fund Name (continued) iShares Global Monthly Dividend Index ETF (CAD-Hedged). CYH. iShares Core. The Global X SuperDividend® ETF (SDIV) invests in of the highest dividend yielding equity securities in the world. This page lists today's ETFs paying the highest annual dividends. Many investors will look for ETFs with a high dividend for investment. income distributions for the previous seven days. Sort table descending by DistributionThe fund's current monthly income dividend per. Dividend ETF List: ETFs ; DGRW, WisdomTree U.S. Quality Dividend Growth Fund, WisdomTree ; NOBL, ProShares S&P Dividend Aristocrats ETF, ProShares ; HDV. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF .

List of monthly dividend stocks · Realty Income [O] · Prospect Capital Corp [PSEC] · Shaw Communications [SJR] · LTC Properties [LTC] · Itaú Unibanco [ITUB]. 1. Pays monthly dividend income. · 2. Low cost. · 3. Designed to be a long-term foundational holding. Loading. Fund details, performance, holdings, distributions and related documents for Schwab U.S. Dividend Equity ETF (SCHD) | The fund's goal is to track as closely. The iShares Core High Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities. Top Highest Dividend Yield ETFs ; EWT · iShares MSCI Taiwan ETF, % ; MORT · VanEck Mortgage REIT Income ETF, % ; PUTW · WisdomTree PutWrite Strategy. ETFs. Full ETF List. YieldMax™ ETFs seek to generate monthly income by pursuing options-based strategies on one or more underlying securities. YieldMax™ ETFs. Generate growth and income with the TD Enhanced Dividend ETFs: TD Active Global Enhanced Dividend ETF (TGED), TD Active U.S. Enhanced Dividend ETF (TUED). The iShares Emerging Markets Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging. Defiance R Enhanced Options Income ETF. IWMY · $ +%. $ M · %. $ ; Defiance Nasdaq Enhanced Options Income ETF. QQQY · $ +. The Fidelity Canada Dividend for Rising Rates Factor Index is designed to find companies that are not only expected to pay and grow their dividends but also. The best global dividend ETF by 1-year fund return as of ; 1, Franklin Global Quality Dividend UCITS ETF, +% ; 2, iShares MSCI World Quality. Schwab International Dividend Equity ETF. Type: ETFs Symbol: SCHY Net Expense Ratio: %. If you own shares of an exchange-traded fund (ETF), you may receive distributions in the form of dividends. These may be paid monthly or at some other. LIST Stocks · D.D. Premium Info · D.D. Premium Join. DIVIDEND DETECTIVE Premium Call Monthly % NIFE Direxion Fallen Knives Quarterly %. Freq. 53 Stocks ; PNNT, PennantPark Investment Corporation, % ; SPMC, Sound Point Meridian Capital, Inc. % ; HRZN, Horizon Technology Finance Corporation. QQQY, the first put-write ETF using daily options (0DTE) to seek enhanced income for investors. Paid Monthly dividends paid by any companies that comprise the. Some ETFs pay dividends every quarter, while others may pay dividends monthly or annually. You can typically find a dividend schedule for an ETF on the fund's. Vanguard High Dividend Yield ETF (VYM) - Find objective, share price, performance, expense ratio, holding, and risk details. However, it's important to remember that, unlike the coupon payments on bonds, dividend payments are not guaranteed. Why have them in your portfolio? Dividend. This page lists today's ETFs paying the highest annual dividends. Many investors will look for ETFs with a high dividend for investment.

Loan Lend Borrow

Financing options range from traditional financial institutions, such as banks, credit unions, and financing companies, to peer-to-peer lending (P2P) or a loan. Through proprietary technology and algorithms, we're driving a better lending and borrowing experience by finding more reasons to say “yes.” After serving. Loan vs. Lend. 'Loan' has been a verb in English for years. So why are people still complaining about it? "Borrow" when the person receiving the item is the subject of the verb "borrow". On the other hand, "lend" is used when the receiver of the item becomes the. You can borrow 10 books at a time from narodpp.ru Each loan will expire after 2 weeks and will automatically “return” at the end of that time period. (a) Permissible Lending Arrangements; Conditions No person associated with a member in any registered capacity may borrow money from or lend money to any. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. (a) Permissible Lending Arrangements; Conditions No person associated with a member in any registered capacity may borrow money from or lend money to any. Lend refers to the giver. · Borrow refers to the receiver. · Can “YOU” lend me your lawnmower? · Can “I” borrow your lawnmower? · Both sentences. Financing options range from traditional financial institutions, such as banks, credit unions, and financing companies, to peer-to-peer lending (P2P) or a loan. Through proprietary technology and algorithms, we're driving a better lending and borrowing experience by finding more reasons to say “yes.” After serving. Loan vs. Lend. 'Loan' has been a verb in English for years. So why are people still complaining about it? "Borrow" when the person receiving the item is the subject of the verb "borrow". On the other hand, "lend" is used when the receiver of the item becomes the. You can borrow 10 books at a time from narodpp.ru Each loan will expire after 2 weeks and will automatically “return” at the end of that time period. (a) Permissible Lending Arrangements; Conditions No person associated with a member in any registered capacity may borrow money from or lend money to any. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. (a) Permissible Lending Arrangements; Conditions No person associated with a member in any registered capacity may borrow money from or lend money to any. Lend refers to the giver. · Borrow refers to the receiver. · Can “YOU” lend me your lawnmower? · Can “I” borrow your lawnmower? · Both sentences.

Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. The word “lend” is the same as the word “loan.” (Loan can also be a noun, referring to the money that is lent/loaned.) They both start with an L. To lend or to. Limiting loans to friends or family members you trust to pay back what they owe can help you avoid financial and emotional headaches later. Most possibilities just need financing · Mortgage lending · Home equity loans & lines of credit · Personal loans · Student loans. Lend means 'give something to someone for a short time, expecting that you will get it back'. The past simple and the -ed form are lent. To borrow in DeFi, users must use cryptocurrency collateral in the form of other tokens that are worth more than the value of the loan itself — usually at least. Payday loans and doorstep lending, for instance, can lead to a debt spiral where you're constantly trying to catch up with the interest, making it harder to pay. Borrow (verb) to take something with a promise it will be returned. Lend (verb) to give something with a promise it will be returned. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees All loan requests. How a Personal Loan with LendingClub Works · Apply In Minutes. Get customized loan options based on what you tell us. · Choose a Loan Offer. Select the rate. Loan can be used with the same meaning as lend. It's more associated with finance, but that example is perfectly fine. (Note that only "loan" is. A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly. Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. So lending – giving temporarily. And borrowing – taking temporarily. Borrow is a regular verb – borrow, borrowed, borrowed. Lend is an irregular verb – lend. The words "borrow" and "lend" can be super confusing, so it's easy to mix them up. "Borrow" means you want to take something that belongs to someone else. Limiting loans to friends or family members you trust to pay back what they owe can help you avoid financial and emotional headaches later. Borrowing money is a way to purchase something now and pay for it over time. But, you usually pay “interest” when you borrow money. The longer you take to pay. Ratings and Reviews · This is literally the best lending app there is. I have been using them for months now. You can either request a loan or you can make money. If a company is granted a loan from its bank, the company is borrowing money from its bank, and the bank is lending money to one of its customers. To borrow something from somebody or something. to receive money from a person, an organization, or a bank which you must pay back later.

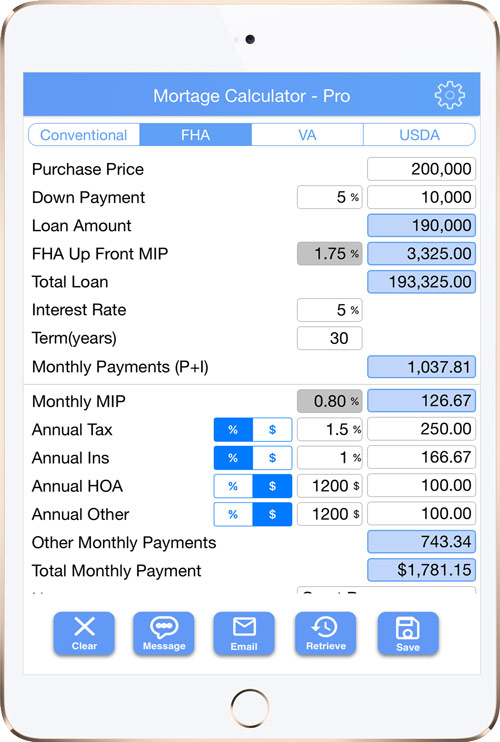

How Much Is Pmi Calculator

For loans secured with less than 20% down, PMI is estimated at % of your loan balance each year. Use this 2/1 Buydown Calculator to explore the reduced monthly payments available with the loan program. This unique mortgage calculator will not only generate an amortization schedule, but will also show the Private Mortgage Insurance payment that may be required. Find ways to reduce your mortgage insurance costs with this Navy Federal Credit Union calculator. Track the costs of mortgage insurance By making a larger down payment, you can reduce or eliminate the need for private mortgage insurance, which is added to. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Enter your home price and loan information into the MoneyGeek Private Mortgage Insurance Calculator to learn an estimate of how much you will pay for PMI. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. This calculator indicates how long it may take before ratios of loan balance to property value allow termination of mortgage insurance. For loans secured with less than 20% down, PMI is estimated at % of your loan balance each year. Use this 2/1 Buydown Calculator to explore the reduced monthly payments available with the loan program. This unique mortgage calculator will not only generate an amortization schedule, but will also show the Private Mortgage Insurance payment that may be required. Find ways to reduce your mortgage insurance costs with this Navy Federal Credit Union calculator. Track the costs of mortgage insurance By making a larger down payment, you can reduce or eliminate the need for private mortgage insurance, which is added to. Use our mortgage calculator to calculate monthly payment along with Taxes, Insurance, PMI, HOA & Extra Payments on your home mortgage loan in the U.S. Enter your home price and loan information into the MoneyGeek Private Mortgage Insurance Calculator to learn an estimate of how much you will pay for PMI. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. This calculator indicates how long it may take before ratios of loan balance to property value allow termination of mortgage insurance.

Use SmartAsset's free Florida mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Just enter the home price, your down payment amount, the interest rate, and the loan term, then press calculate and our mortgage calculator does the rest! You. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. Estimate your monthly payments, what you might need for a down payment and mortgage insurance at closing using the calculator below. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Mortgage Calculator ; Loan Term? years ; Interest Rate? ; Start Date ; Include Taxes & Costs Below ; Annual Tax & Cost. Property Taxes? · Home Insurance? · PMI. Mortgage payment formula ; P · Principal loan amount ; r, Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Your estimated total monthly payment: $1, ; Purchase price. Must be between $1 and $1,,, ; Down payment ($50K). Must be between % and %. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each year. Use this simple, free mortgage calculator to get an idea about how much home you can afford. Includes PMI and ammoratazation schedule. HSH offers a great PMI Calculator to calculate how much your mortgage insurance will cost you each month. See PMI costs for conforming and jumbo loans for. mortgage insurance premium (MIP) with this free FHA loan calculator How Much of an FHA Mortgage Payment Can I Afford? If you're considering an. For a new mortgage, subtract your down payment from the home price. Calculate the LTV. Divide the loan amount by the property value. Then multiply by to get. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details. Your estimated total monthly payment: $1, ; Purchase price. Must be between $1 and $1,,, ; Down payment ($50K). Must be between % and %. For example, if the PMI rate is % and your loan amount is $,, your PMI will cost $1, annually or $ monthly. The Bottom Line. If your down payment. Find ways to reduce your mortgage insurance costs with this Navy Federal Credit Union calculator.

How To Invest Money Online

:max_bytes(150000):strip_icc()/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Many online brokers have eliminated account minimums, making it easier for more investors to get started.4 If you have just a few dollars to invest, you can. The first step to investing, especially investing on your own, is to make sure you have a financial plan. How much are you going to invest? For how long? Here's how to invest money, step-by-step. We'll walk you through how to choose, manage, and keep an eye on your investments. How could you find extra money to put toward your future? Let's say you're perusing online when an ad for $ shoes catches your eye. Instead of dropping. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. cash quickly just by investing $1,? The answer to that is a resounding, "Yes." While there are plenty of ways you can make money fast by doing odd online. You'll gain exposure to the markets as soon as possible. · Historical market trends indicate the returns of stocks and bonds exceed returns of cash investments. Investment platforms offer an online gateway into the stock market for investors of all kinds. They will host your Individual Savings Account (Isa) or Self-. An Investment Process Refined to Perfection with Quanloop. We operate a suite of investment funds serving a community of over investing partners. Many online brokers have eliminated account minimums, making it easier for more investors to get started.4 If you have just a few dollars to invest, you can. The first step to investing, especially investing on your own, is to make sure you have a financial plan. How much are you going to invest? For how long? Here's how to invest money, step-by-step. We'll walk you through how to choose, manage, and keep an eye on your investments. How could you find extra money to put toward your future? Let's say you're perusing online when an ad for $ shoes catches your eye. Instead of dropping. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. cash quickly just by investing $1,? The answer to that is a resounding, "Yes." While there are plenty of ways you can make money fast by doing odd online. You'll gain exposure to the markets as soon as possible. · Historical market trends indicate the returns of stocks and bonds exceed returns of cash investments. Investment platforms offer an online gateway into the stock market for investors of all kinds. They will host your Individual Savings Account (Isa) or Self-. An Investment Process Refined to Perfection with Quanloop. We operate a suite of investment funds serving a community of over investing partners.

You can get started for free. We offer unlimited $0 commission online trades FootnoteOpens overlay, including stocks, ETFs, mutual funds and. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Join the millions of people using the narodpp.ru app every day to stay on top of the stock market and global financial markets! Moonfare is a private equity investing platform making top-tier funds available to retail and institutional investors at lower minimums. Whether you want to learn the nuts and bolts about investing or are simply looking for a customized portfolio, Schwab can help you invest. Receive custom insights to help optimize your investment portfolio using our online Our funds are backed by our storied history of investing and money. Online investing opportunities in the best new startup businesses, and raise seed and angel investment, with top European equity crowdfunding site Republic. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Online safety · Protect yourself from scams · Online Be cautious when transferring money for investments and always cross-check the bank account details. It doesn't matter if you're about to buy your first share or pick a stock market fund for the first time, always ask yourself WHY you're looking to invest. Over. DIY investing. Manage your own investments (stocks, ETFs, mutual funds, CDs, and more), with help from our free resources. Mutual funds are similar to ETFs. They pool investors' money and use it to accumulate a portfolio of stocks or other investments. The biggest difference is that. Start your investing journey · Do it yourself. Illustration of a compass and map. Create and monitor a portfolio and get help any time you need it. Invest on. Easy steps to start investing online · 1 · Open an account · 2 · Put money in · 3 · Pick an investment · 4 · Place your trade. The first step is outlining your goal(s) for the money you're investing. Your goals could be buying a home, funding education, or saving for retirement. All the. Mutual funds are a trendy investment avenue amongst beginners. Mutual funds offer you the advantage of investing indirectly into stock markets through the. Investing made easy. · Earn up to 3% in stock with the only debit card that invests in you. · Learn how to invest. · Keep your money secure. · No hidden fees, one. Acorns Checking Real-Time Round-Ups® invests small amounts of money from purchases made using an Acorns Checking account into the client's Acorns Investment. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Investing can help you pursue your most important financial goals, but what should you invest in? The building blocks include stocks, bonds, cash.

How To Make Money On Shorting Stocks

If the price drops, you can buy back the stock at the lower price and make a profit on the difference. If the price of the stock rises, you have to buy it back. Shorting a stock is the act of betting against a company's share price, expecting it to decline. In this strategy, you borrow shares to sell them at the. You sell someone else's shares, get the money, then replace the shares when you cover the short. You borrow the stock from your broker's inventory, the shares are sold, and proceeds are credited to your account. At some point (ideally when the value has. When shorting a stock via a traditional broker, traders borrow shares they do not own. These shares are usually lent from their financial broker. The trader. Understand How Shorting Works · Identify the Stock That You Want to Short Sell · Create a tastytrade Margin Account or Log In · Decide How You Want to Short the. In How to Make Money Selling Stocks Short, William J. O'Neil offers you the information needed to pursue an effective short selling strategy, and shows you Jill sold shares at $ x $ = $3, (Short Selling) make money if the stock price goes down and lose money if the price goes up. Keep in mind that you are paying interest to your brokerage, which will reduce the profit you earn on the short sell. However, with short selling comes. If the price drops, you can buy back the stock at the lower price and make a profit on the difference. If the price of the stock rises, you have to buy it back. Shorting a stock is the act of betting against a company's share price, expecting it to decline. In this strategy, you borrow shares to sell them at the. You sell someone else's shares, get the money, then replace the shares when you cover the short. You borrow the stock from your broker's inventory, the shares are sold, and proceeds are credited to your account. At some point (ideally when the value has. When shorting a stock via a traditional broker, traders borrow shares they do not own. These shares are usually lent from their financial broker. The trader. Understand How Shorting Works · Identify the Stock That You Want to Short Sell · Create a tastytrade Margin Account or Log In · Decide How You Want to Short the. In How to Make Money Selling Stocks Short, William J. O'Neil offers you the information needed to pursue an effective short selling strategy, and shows you Jill sold shares at $ x $ = $3, (Short Selling) make money if the stock price goes down and lose money if the price goes up. Keep in mind that you are paying interest to your brokerage, which will reduce the profit you earn on the short sell. However, with short selling comes.

Short selling aims to profit by borrowing shares from a broker, selling them, and then purchasing the shares later at a lower price (so you can give them. A manipulator can repeatedly buy stocks and then sell them to earn a profit because purchases having the greater price impact. But selling and then buying would. Short selling is a regulated and widely used strategy. Investors use short selling when they believe, based on fundamental research, that a stock price is. You can go short on a market of your choice, via CFD trading, or by borrowing stock from a broker · If the underlying market price dips, you could make a profit. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. In fact, we can also do it in a reverse order by selling a stock first and buying it later. This is called short selling. You have no stocks at hand initially. In How to Make Money Selling Stocks Short, William J. O'Neil offers you the information needed to pursue an effective short selling strategy, and shows you How does a short sale work? · Choose the stock you believe will decline in value. · Make sure you have a margin account before you can short sell. · Contact your. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than. Typically you need to have a margin account — an account where you can borrow money from your broker — to short a stock directly. Short selling works by. Short selling occurs when an investor borrows a stock and then sells it on the open market before buying it back at a lower cost. Short selling. Short selling is a regulated and widely used strategy. Investors use short selling when they believe, based on fundamental research, that a stock price is. The traditional way to profit from stock trading is to “buy low and sell high”, but you do it in reverse order when you wish to sell short. To sell short, you. The most basic is physical selling short or short-selling, by which the short seller borrows an asset (often a security such as a share of stock or a bond) and. Short selling is an investment strategy where the investor profits if the stock price drops. Someone will borrow shares under the agreement the stocks will be. Keep in mind that you are paying interest to your brokerage, which will reduce the profit you earn on the short sell. However, with short selling comes. Investors who sell stock short typically believe the price of the stock will fall and hope to buy the stock at the lower price and make a profit. Short selling. How To Short Sell: 10 Tips To Get You Started · Proceed With Caution · Use Stop Orders · Understand How to Use Margin · Shorting shares of stock is best used as a. Margin accounts are brokerage accounts that allow investors to borrow money or shares to make trades. To short a stock, you will place a sell order for the. Short selling is a great strategy to help you make money during these bear markets. When you're shorting the market, what you're doing is you are selling a.

When Is 5g Home Internet Coming

5G can be used for home internet, but your internet performance depends on the quality of 5G coverage in your area. What are the disadvantages of 5G? s: 4G LTE ushered in the era of mobile broadband. 1G, 2G, 3G, and 4G all led to 5G, which is designed to provide more connectivity than was ever available. Find out if you're eligible for T-Mobile's fast, in-home 5G Internet. We're working hard to bring our 5G internet across the country, so check back often! Best 5G Home Wireless Broadband Provider · Your Favourite Entertainment · Plans include our Optus Ultra WiFi 5G Modem · Come home to amazing Optus 5G home internet. 5G Home Internet service is advertised as fast, but it's not yet as consistent or reliable as the wired connection delivered by Sparklight Internet. Read the. Verizon 5G customer service specialists are available 24/7 and trained to assist you as you navigate tech, troubleshoot difficulties, and make the best of your. Check your internet availability for T-Mobile's fast, in-home 5G internet by address. We're working hard to deliver our 5G internet across the country. 5G Home is Verizon's base internet plan, and it comes with download speeds between 85 and Mbps, along with a two-year price guarantee. Straight Talk Home Internet service available in select areas. Actual availability, coverage, and speeds may vary depending on address/location, signal strength. 5G can be used for home internet, but your internet performance depends on the quality of 5G coverage in your area. What are the disadvantages of 5G? s: 4G LTE ushered in the era of mobile broadband. 1G, 2G, 3G, and 4G all led to 5G, which is designed to provide more connectivity than was ever available. Find out if you're eligible for T-Mobile's fast, in-home 5G Internet. We're working hard to bring our 5G internet across the country, so check back often! Best 5G Home Wireless Broadband Provider · Your Favourite Entertainment · Plans include our Optus Ultra WiFi 5G Modem · Come home to amazing Optus 5G home internet. 5G Home Internet service is advertised as fast, but it's not yet as consistent or reliable as the wired connection delivered by Sparklight Internet. Read the. Verizon 5G customer service specialists are available 24/7 and trained to assist you as you navigate tech, troubleshoot difficulties, and make the best of your. Check your internet availability for T-Mobile's fast, in-home 5G internet by address. We're working hard to deliver our 5G internet across the country. 5G Home is Verizon's base internet plan, and it comes with download speeds between 85 and Mbps, along with a two-year price guarantee. Straight Talk Home Internet service available in select areas. Actual availability, coverage, and speeds may vary depending on address/location, signal strength.

5G Home Internet brings internet directly to your home using the mobile network. No landline or technical skills required – just plug in your modem, and you're. Verizon 5G Home Internet offers two plans in areas with 5G coverage. Both plans have no annual contracts or data caps and currently have a two and three-year. 5G Home Internet is only available in select cities. What does 5G Home Internet cost? The price. Probably not. First, 5G internet is not available everywhere, and where it is available 5G home internet has considerable limitations and will not be the. Is 5G available for home internet? Yes, Verizon, T-Mobile, and Starry Internet offer 5G home internet service. Is 5G faster than fiber-optic internet? 5G Ultra Wideband and 5G Home available in select areas. Order online. Add the perks you want. Choose what you love and save on all of it. Like Netflix. Both T-Mobile 5G Home Internet and Verizon 5G Home Internet should theoretically be available wherever their respective cellular networks are present. If you. A better choice for home broadband internet is finally here. Learn more about our affordable prepaid unlimited in-home 5G internet service. Verizon 5G Home Internet offers fixed wireless internet plans in 34 states starting at $35/mo. Find a Verizon wireless internet plan near you today. T-Mobile is hands-down the easiest home internet provider I've ever dealt with when it comes to billing and the “fine print” most carriers tack on. Areas that have access to Verizon FIOS will not have access to 5G UW because there is the hardline service available in the area. 5G UW for home. Verizon 5G home internet availability · Indianapolis, IN · Detroit, MI · Minneapolis, MN · Saint Paul, MN · Dallas, TX · Houston, TX. Verizon offers wireless home internet powered by 5G Ultra Wideband that has two plan tiers: Verizon 5G Home and Verizon 5G Home Plus. The lowest plan usually. If the website says your address qualifies then it qualifies. The system not only checks for 5G coverage, but it also checks for capacity as. Though 5G home internet is available in most metro areas, speeds aren't guaranteed, and households may experience interruptions as they compete with mobile. 5G home internet is a relatively new service provided by wireless carriers T-Mobile, AT&T, and Verizon. Speeds range from 30Mbps to 1,Mbps and plans come at. 5G Home Internet is ready to go out of the box — just plug in and go. Do-it-yourself installation takes less than 15 minutes! Get connected fast with all the. 5G Ultra Wideband-powered internet for your whole home. Plans start at $35/mo. With select 5G mobile plans with Auto Pay. Experience the power of Ultra Wideband from the comfort of your couch. Verizon 5G Home Internet plans start at $35/mo. With AutoPay and select mobile plans. 5G Home Internet brings internet directly to your home using the mobile network. No landline or technical skills required – just plug in your modem, and you're.

Documents Required For Loan Approval

Documents required for any loan application · One (1) Valid unexpired national photo identification · Tax Registration Number (TRN) · One (1) valid proof of. Developing a loan checklist ensures you have all of the information you need before meeting with a lender and can also help you get prequalified for a home. Although the exact documents can vary, they all fall into categories of proving your credit history, identity, address and income. This can be in the form of recent pay stubs, tax returns, bank statements, or employment verification letters. Self-employed individuals may need to provide. Documents that homeowners and homebuyers will need to provide their mortgage company if they are refinancing or purchasing a home. Loan administration procedures. • Documentation, approval and reporting requirements. Consistent with the agencies regulations on real estate lending. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs. Documents required · KYC documents: Aadhaar/ passport/ voter's ID/ driving license/ Letter of National Population Register/ NREGA job card · PAN card · Employee ID. Table of Contents · What Documents Do You Need for a Personal Loan? Photo Identification; Loan Application; Proof of Income · What Information Will Lenders Need. Documents required for any loan application · One (1) Valid unexpired national photo identification · Tax Registration Number (TRN) · One (1) valid proof of. Developing a loan checklist ensures you have all of the information you need before meeting with a lender and can also help you get prequalified for a home. Although the exact documents can vary, they all fall into categories of proving your credit history, identity, address and income. This can be in the form of recent pay stubs, tax returns, bank statements, or employment verification letters. Self-employed individuals may need to provide. Documents that homeowners and homebuyers will need to provide their mortgage company if they are refinancing or purchasing a home. Loan administration procedures. • Documentation, approval and reporting requirements. Consistent with the agencies regulations on real estate lending. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs. Documents required · KYC documents: Aadhaar/ passport/ voter's ID/ driving license/ Letter of National Population Register/ NREGA job card · PAN card · Employee ID. Table of Contents · What Documents Do You Need for a Personal Loan? Photo Identification; Loan Application; Proof of Income · What Information Will Lenders Need.

The 7 documents you need when applying for a home loan · A completed and signed application form. · A copy of your ID document. · Proof of residence. · A copy of. Financial documents: In some cases, you might need to provide bank statements. These statements illustrate when you expect to have regular deposits into your. Personal financial statements – Lenders may also require you to provide personal financial details such as income (outside the business), assets and investments. Photo identification: A copy of a government-issued photo ID, such as a passport, driver's license, or state identification, may be required to verify your ID. IRS Form C - Request for Transcript of Tax Return (PDF) Power of Attorney (PDF) Applicant employment and income authorization form (PDF). This document is required by lenders prior to loan approval, borrowers must sign original copy at time of closing. Loan Servicing Disclosure: The collection of. Lenders will want to review both the credit history of your business (if the business is not a startup) and, because a personal guarantee is often required for. When you apply for a personal loan, your application is approved based on whether you meet requirements including a solid credit score. Photo identification: A copy of a government-issued photo ID, such as a passport, driver's license, or state identification, may be required to verify your ID. Be proactive in answering questions posed by your lender/financial institution and provide any additional requested documentation in a timely manner;; Please. Pay stub for the last 30 days · W-2 forms for the last two years · Signed federal tax return for the last two years · Documentation of other sources of income. First, ask yourself why you need the loan. Next, find the right loan to match your needs. And finally, craft a solid loan application using the right documents. Identification and resident status: The borrower may need to supply a social security number (SSN) so you can associate their loan application with their credit. Commonly required documents · Documentation for identity verification · Documentation for address verification · Proof of income for salaried individuals · Proof of. Generally speaking, most lenders require proof of income, though some may offer unsecured loans without verifying your income. Secured loan lenders might issue. Application Checklist · Adding a co-signer? The same information and documents will also be needed from them · Applying to consolidate debt? We'll need up- to-. Verification of income such as letter of appointment, personnel action form, or pension statement · Two most recent pay statements · Acceptance letter or current. The Application and Approval#. Once you apply, the lender will assess your credit, employment history, assets, and property value. Prompt responses to any. Your credit report is usually all that is required to prove your liabilities, but your lender will want to see property appraisals, savings and stock account. Form RD 25 need not be executed until loan closing, and must be returned, along with the other closing documents. Page 7. HB (

Jet Suite X Cost

JSX Executive Overview ; Year Founded. ; Headquarters. Dallas, Texas ; Jet Card Hourly Rates. JSX offers seats on scheduled flights. Per seat prices range. I have just tried JetSuiteX on a flight from Las Vegas to Burbank. I paid $ for the ticket which was great value for money. I am very impressed by the whole. Sip and sit back with business class amenities on spacious seat jets offering free Starlink Wi-Fi. Fly like nobody's business in Mint, JetBlue's award-winning take on premium travel, with lie-flat seats and suites, a small plates menu, free wi-fi and. Tickets for Trending Flights on JSX ; Burbank (BUR) · 10/07/ - 10/10/ · $*. Seen: 16 hrs ago ; Los Angeles (LAX) · 10/27/ - 10/31/ · $1,*. Seen. New York Jets suites cost between $9,$30, for most games. Prices vary on the opponent, day of game, and suite location in MetLife Stadium. Jsx is x the price of an economy ticket on the same legs from what I've seen. So figure you take a similar sized commercial plane, they would. cost out of my pocket). JSX aircraft interiors are not as plush as a There was no stress in flying JSX which used to be called Jet Suite. There are. Flights are public charters sold by JetSuiteX, Inc. as the charter operator and Delux Public Charter, LLC as the direct air carrier, subject to DOT Public. JSX Executive Overview ; Year Founded. ; Headquarters. Dallas, Texas ; Jet Card Hourly Rates. JSX offers seats on scheduled flights. Per seat prices range. I have just tried JetSuiteX on a flight from Las Vegas to Burbank. I paid $ for the ticket which was great value for money. I am very impressed by the whole. Sip and sit back with business class amenities on spacious seat jets offering free Starlink Wi-Fi. Fly like nobody's business in Mint, JetBlue's award-winning take on premium travel, with lie-flat seats and suites, a small plates menu, free wi-fi and. Tickets for Trending Flights on JSX ; Burbank (BUR) · 10/07/ - 10/10/ · $*. Seen: 16 hrs ago ; Los Angeles (LAX) · 10/27/ - 10/31/ · $1,*. Seen. New York Jets suites cost between $9,$30, for most games. Prices vary on the opponent, day of game, and suite location in MetLife Stadium. Jsx is x the price of an economy ticket on the same legs from what I've seen. So figure you take a similar sized commercial plane, they would. cost out of my pocket). JSX aircraft interiors are not as plush as a There was no stress in flying JSX which used to be called Jet Suite. There are. Flights are public charters sold by JetSuiteX, Inc. as the charter operator and Delux Public Charter, LLC as the direct air carrier, subject to DOT Public.

cost of flying Southwest The cons: 1) lackluster beverage offerings in Jet Suite X this past week. Arrived to Concord in the middle of a rain storm. Citation X+ Price Rental. The average cost to charter Citation X+ is around $6, per hour. For charter rates and availability of Citation X+, please submit. cost out of my pocket). JSX aircraft interiors are not as plush as a There was no stress in flying JSX which used to be called Jet Suite. There are. Sip and sit back with business class amenities on spacious seat jets offering free Starlink Wi-Fi. Flying JSX allows you to travel in style between private terminals on roomy seat jets. No lines, no crowds, no hassles. Simply hop on and go! Hop On: $50 per person per direction for nonstop, connections, or Thru flights. Fee is waived within 24 hours after initial purchase. Failure to change a Hop On. New York Jets suites cost between $9,$30, for most games. Prices vary on the opponent, day of game, and suite location in MetLife Stadium. price of commercial. And you can earn TrueBlue points with every flight between select West Coast cities. JSX will get you there faster than any airline. Private Jet Prices – Ballpark Hourly Rates ; Midsize Jet, Lear 60, , $2, – $3, ; Supermidsize Jet, Citation Sovereign, , $3, – $5, Flights are public charters sold by JetSuiteX, Inc. as the charter operator and Delux Public Charter, LLC as the direct air carrier, subject to DOT Public. Buy JSX Flights with Alternative Airlines. JSX, formerly Jet Suite X, is a US airline that offers passenger flights across the western states of the country. Depending on the route, a one-way seat between major cities on Jet Suite X may cost $ to $ Stretch out in luxurious leather seating with just Chartering a Citation X jet will cost from $6, per hour. The Cessna Citation jet rental cost may depend on the flight range, the airport for landing, the. The price varies based on the jet's size and type. For example, smaller jets cost around $1, to $2, per hour, midsize jets range from $6, to $8, per. JetSuite's scheduled charter-flight platform JetSuite X. The aircraft has a take-off distance of 2, feet and a low expected operating cost of 8¢/seat mile. JetSuiteX only flies from private jet facilities. There are no crowded terminals, long security lines, or giant parking lots. Regular fares start from $99* each. Private Jet Prices – Ballpark Hourly Rates ; Midsize Jet, Lear 60, , $2, – $3, ; Supermidsize Jet, Citation Sovereign, , $3, – $5, The cost to rent a private jet varies from $2, – $14, per billable flight hour. These hourly rates include a broad selection of aircraft from turboprops. The average hourly rental rate of the Citation X+ is around 5, USD per hour. The average purchase price of a new Citation X+ is 28,, USD. The average. For some apps, such as Blackbird Air or JetSuiteX, you could be looking at costs as low as $30 for a seat! That's a great deal compared to other commercial.

Employee Buying Shares In Private Company

A stock option is a contract that gives its owner the right, but not the obligation, to buy or sell shares of a corporation's stock at a predetermined price by. Employee stock ownership plans (ESOPs) have many advantages, but they are not right for every company in every situation. Below we discuss many ESOP pros and. Stock Purchase Plans Permits employees to purchase equity in the company at a discount to fair market value. Provides an incentive to employees by allowing. to employees that might otherwise not have the funds to buy into the company. Because the shares of private companies are inherently illiquid, employees may. Learn more about selling private company stock. Explore the practical considerations that employees must navigate to convert shares to cash. In a private company setting, after the founders have been issued fully vested or restricted stock under their stock purchase agreements, the employees. Employee stock options (ESOs) are a grant awarded to an employee giving them the right to buy a certain number of shares of the company's stock for a set. Lately, I've been seeing a fair amount of companies start to grant shares to employees only to realize that the shares are so expensive that it's going to. The generous tax benefits of ESOPs don't outweigh these considerations in these firms, Instead, TeamShares buys the company and then provides A stock option is a contract that gives its owner the right, but not the obligation, to buy or sell shares of a corporation's stock at a predetermined price by. Employee stock ownership plans (ESOPs) have many advantages, but they are not right for every company in every situation. Below we discuss many ESOP pros and. Stock Purchase Plans Permits employees to purchase equity in the company at a discount to fair market value. Provides an incentive to employees by allowing. to employees that might otherwise not have the funds to buy into the company. Because the shares of private companies are inherently illiquid, employees may. Learn more about selling private company stock. Explore the practical considerations that employees must navigate to convert shares to cash. In a private company setting, after the founders have been issued fully vested or restricted stock under their stock purchase agreements, the employees. Employee stock options (ESOs) are a grant awarded to an employee giving them the right to buy a certain number of shares of the company's stock for a set. Lately, I've been seeing a fair amount of companies start to grant shares to employees only to realize that the shares are so expensive that it's going to. The generous tax benefits of ESOPs don't outweigh these considerations in these firms, Instead, TeamShares buys the company and then provides

You might have an opportunity to buy or receive shares in your company either as part of your company's retirement plan, or through an employee stock. You won't be affected if you're being paid for your work with a straightforward salary. But in some cases, companies offer various types of equity compensation. You might think that you can buy them out later, but in reality, this is unlikely. As your company's value increases, you may find you cannot buy out that. An effective tool for owners of private companies, to attract and retain talented employees, is to offer them an ownership interest in the company. The employer may allow employees to purchase stock for full value or for a discounted price. To the extent an employee pays full value for shares, no taxable. Employee stock options are a popular form of equity compensation offered by companies to attract, motivate and retain talent. Stock options give employees the right to buy a specific number of shares of the company, at a set price, by the option's expiration date. When company stocks. Most companies operate some sort of employee stock ownership scheme, in which businesses allocate a free portion of stock to workers without any direct cost to. If you hold private company shares – whether as an employee or an early investor – Forge can help connect you with accredited investors to potentially. In both cases, your employees will actually receive equity over time depending on their vesting schedule, but with stock, the employee is treated as “owning”. Employee stock ownership, or employee share ownership, is where a company's employees own shares in that company US employees typically acquire shares. Company Rights. Private companies often retain certain rights upon the grant of equity. These rights may include a right of first refusal, a stock buyback, and/. Stock options are often given by companies to their employees as incentives and bonuses Say, hypothetically, you have the option to buy 1, shares of your. In an employee share scheme, you get shares or can buy shares in the company you work for. This is also known as an employee share purchase plan, share options. The company borrows money from a bank and then lends the proceeds to a trust, which uses those funds to buy the owner's shares. In order to qualify as an ESOP. Typically, this is the result of a private equity buyout, management buyout, or tender offer. Before going private, a public company must receive shareholder. Private Company: For employees in private companies, selling RSU shares requires waiting for a liquidity event, such as an acquisition, merger, or IPO. > $1, Tax Exempt Plan: This is where every employee is able to buy or get free shares in their employing company up to $1, per financial year. The. You are absolutely allowed to trade stock in the company you work for. However, I cannot recommend against doing so strongly enough. You cannot. SEC Rule 10b-5 prohibits corporate officers and directors or other insider employees from using confidential corporate information to reap a profit (or avoid a.